Catholic investing: The role we play in our investment decisions

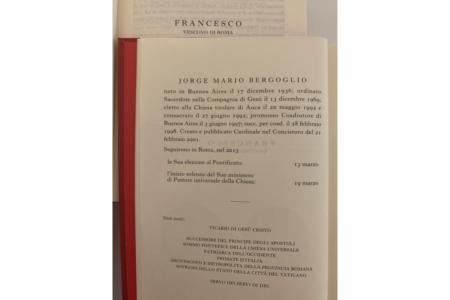

The Vatican recently released a document jointly prepared by the Dicastery for the Promotion of Integral Human Development and the Congregation for the Doctrine of the Faith titled, "Considerations for an Ethical Discernment Regarding Some Aspects of the Present Economic-Financial System."

While stronger in its rebuke and more specific in naming the abuses, its thesis is not new and follows earlier papal documents in locating financial market and economic conduct within the realm of human and relational activities that, according to church teachings, must strive for the common good and the well-being of all.

The document indicates that profits, trading, financial credits are not in themselves bad, but condemns the distortions, abuses and exploitation that result when profits dominate and drive out the ethical impulse to care for the other. The market cannot regulate itself nor correct its corruptions; people must do this.

The last two sections (Nos. 33-34) pivot to each of us, through consumption and savings decisions, to help shape markets for human flourishing. Yet no further discussion is provided beyond this general exhortation. Much has been written elsewhere, for example in "Laudato Si'," which connects consumption to impact on the environment, the poor and the potential clout to bring about positive corporate behavior. On the role that we can play in our investment decisions, the church has been relatively silent.

Having spent 20 years on this topic, I can say that never before are there as many opportunities to bring about socially responsible conduct through our investments. The confluence of different forces empowers investors to educate themselves about and monitor corporate performance along environmental, social and governance (ESG) dimensions. Disclosure requirements, increasingly rigorous standards, watchdog groups, ubiquitous reporting and affordable big data computation have enabled comprehensive rating and "outing" of bad corporate behavior.

Pressure by certain large investor groups, millennials, pension funds and religious institutes have given teeth to the data when these are used to raise questions and seek accountability. Many funds now are composed of companies that meet certain standards on environmental, social and governance performance. Emerging is the ability to customize a person's investments by selecting profitable companies that also deliver strong performance on the specific values chosen and ranked by the individual.

Another exciting area is impact investing: the use of private capital, sometimes "blended" with philanthropy and public funding, to support businesses that can improve the lives of the poor.

Such investments may deliver risk-adjusted returns over, at, or below the prevailing market rate. Frequently these businesses contribute to job creation, improved health, access to education, agricultural productivity and infrastructure development. One variant is used by about 20 Catholic charities to provide capital for employee-owned ventures or for immigrants to start businesses such as construction, catering, manufacturing and commercial building maintenance.

What holds us back is that not enough people know about such options. Even when they do, the priority remains captured by an obsession to attain the highest returns. Even Catholic funds sometimes punt on the issue of the common good and go no further than the U.S. Conference of Catholic Bishops' guidelines to exclude certain harmful or illicit industries (examples: tobacco, gambling, abortifacients, nuclear arms).

This is not only a pity, but as recent and former Vatican teachings indicate, we fall short of our duties as Catholics. Each of us not only can, but according to doctrine, must contribute to the common good in all activities, our savings and investments included.

"Catholic investing" incorporates a simple question with answers to be backed up by metrics and compensation: How do our investments honor God with a preferential option for the poor and powerless?

- Woo is distinguished president's fellow for global development at Purdue University and served as the CEO and president of Catholic Relief Services from 2012 to 2016.