Pay for emissions

In June 2018 and 2019, the Dicastery for Promoting Integral Human Development and the University of Notre Dame convened leaders from around the world at the Vatican to address the transition of our energy system toward a low carbon economy.

Participants included CEOs from the oil and gas sector, investment firms, renewables and insurance companies, and leaders from civil society. Jointly, they formulated two statements. This column takes up the first of these statements that endorse carbon pricing.

Carbon pricing consists of two broad types of mechanisms to internalize the costs of emissions to society: cap and trade and the imposition of a carbon tax. The latter largely underlies the proposed legislation from both Republicans and Democrats in the United States.

The World Bank lists 57 carbon pricing initiatives either implemented or scheduled around the world in national or subnational jurisdictions. These include three in the United States (California, Massachusetts and Washington), eight in China and 11 in Canada. These jurisdictions cover 20% of global greenhouse gas emissions. While this represents almost a threefold increase of initiatives since 2010, it is too early to determine success and impact.

Carbon pricing creates economic incentives for producers and consumers to reduce their carbon emissions. It places the costs on those who are most responsible for the problem.

By incorporating costs of emissions, companies have a more complete picture of their production costs, returns and relative financial performance of renewables and low carbon technologies. Voter resistance notwithstanding, most governments see carbon pricing as a necessary element of climate policies.

On a moral level, the planet is not a trash bin for the gaseous waste of our consumption. Besides, the principle of scarcity holds, as the absorptive capacity of our air and oceans is operating beyond their limits to support our health and the health of the earth.

The statement delivers an endorsement from all large oil and gas participants for the adoption of carbon pricing that increases the costs of their products and reduces demand.

Amid other points, the statement calls for the level of carbon price to be set high enough "that incentivizes business practices, consumer behavior, research and investment to significantly advance the energy transition while minimizing the costs to vulnerable communities and supporting economic growth."

This principle targets two issues. First, governments generally have not been sufficiently bold to set meaningful rates. The World Bank reports that rates range from $1 per ton of carbon dioxide equivalent to $127, with half of the rates set below $10.

Second, the burden of the energy transition must not fall on the shoulders of at-risk communities such as mining regions and low-income segments. To that end, revenues from the carbon tax can be distributed as a dividend for assistance to these communities, and as subsidies for regional renewal and job creation.

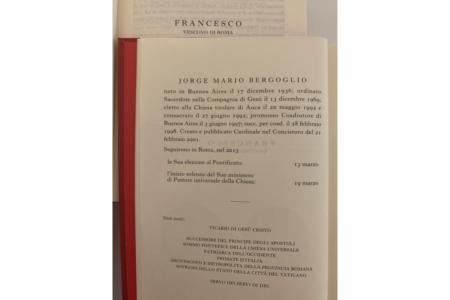

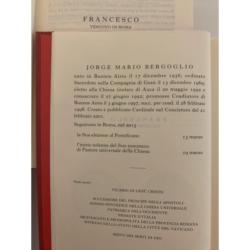

At the dialogue, Pope Francis taught, "Carbon pricing is essential if humanity is to use the resources of creation wisely. The failure to deal with carbon emissions has incurred a vast debt that will now have to be repaid with interest by those coming after us.

"Our use of the world's natural resources can only be considered ethical when the economic and social costs of using them are transparently recognized and are fully borne by those who incur them, rather than by other people or future generations (see "Laudato Si'," No. 195)."

- - -

Woo is distinguished president's fellow for global development at Purdue University and served as the CEO and president of Catholic Relief Services from 2012 to 2016.

- Woo is distinguished president's fellow for global development at Purdue University and served as the CEO and president of Catholic Relief Services from 2012 to 2016.