House defeats church oversight bill

BEACON HILL — The House of Representatives has overwhelmingly voted down a measure that would have given the state the power to oversee church finances.

The House Jan. 25 voted 147-3 to defeat “An Act Relative to Charities.” The bill, sponsored by Sen. Marion Walsh, D-West Roxbury, would have subjected religious organizations to the same financial reporting requirements as other non-profit organizations in the state.

The bill was widely seen as aimed at forcing greater financial disclosure by the Archdiocese of Boston.

Opponents of the bill have said that it is unnecessary and impedes religious freedom by eliminating all existing exemptions in the charitable reporting statues for churches and religious organizations.

In the debate leading up to the vote, several representatives said that, while there may be concern over the use of funds from closed parishes and the archdiocese’s clergy pension fund, the scope of the bill was too broad.

“We don’t give churches tax exemption because they are charities, but to prevent entitlement between the state and the church,” said Rep. Byron Rushing, D-Boston.

“Churches are not public charities. Not only do they not need to be charitable but they are not public,” he said.

Speaking outside the House chambers following the vote The Rev. Diane Kessler, executive director of the Massachusetts Council of Churches, hailed lawmakers’ decision saying “We have believed all along that this legislation was an inappropriate use of the legislative arm to deal with internal concerns” of one denomination.

Director of the Massachusetts Catholic Conference Ed Saunders said, “We now look forward to allowing the archbishop to move foreword with his commitment to financial transparency.”

“The strong vote was a reaffirmation of the separation of church and state in all faiths,” he added.

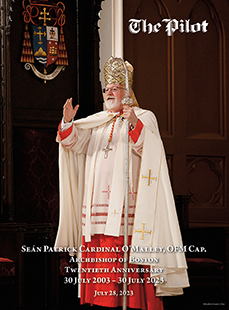

Archbishop Seán P. O’Malley in a pastoral letter last week urged that parishioners call their legislators and request that they vote down S. 1074. The bill “will greatly burden all churches, including the Catholic Church and all of the parishes of the archdiocese,” he said.

“The proposed bill would place religious organizations under the oversight provisions of the Massachusetts Public Charities Law, which empowers the attorney general to investigate the use of charitable funds,” he added. “Depending on the results of any investigation, the attorney general, with court approval, could overrule a church or parish decision concerning the allocation of their resources.”

In addition to this, the bill will require every religious entity, including all parishes, to register with the attorney general’s office in order to take up any collections, which is inconsistent with religious freedom, the archbishop continued.

“All parishes and churches would have to indicate their intent to solicit funds, the purpose of the solicitation, and then provide the attorney general’s office the results of the solicitation,” he said.

In an Oct. 11 letter sent by Walsh to the Massachusetts Catholic Conference, the public policy arm for the Catholic Church in Massachusetts, the senator argued that because the attorney general represents the public interest in the proper use and solicitation of charitable funds, he has the “authority to ensure that charity officials fulfill their fiduciary duties of loyalty to the charity and of due care in properly seeing that the charities carry out their mission.”

Archbishop O’Malley further stated that the proponents of the bill filed it in response to their disagreement with the archdiocese’s decisions concerning parish closings and finances.

“They want to use legislation as a means of exercising control over the affairs of the archdiocese and its parishes. This is not the role of government,” he said.

Walsh originally filed the bill, Senate Bill 1074, in December 2004 for the 2005/2006 legislative session. In August, the bill went before the Joint Committee on the Judiciary, which took it under advisement. It was released to the House on Nov. 7 with a favorable review and referred to the House Steering, Policy and Scheduling Committee.

However, before that bill could be voted on — first by the House and then by the Senate — Sen. Walsh bypassed the normal legislative process to move the matter to the Senate floor on the day the Senate was scheduled to take up health care legislation.

On election day Walsh convinced the Senate Ways and Means Committee in an informal session to take up an existing bill “H2313: An act authorizing the refund of the automobile sales tax to Helen Bergman of Wilmington” and add the language from her original bill, S1074. This in effect, created a new bill, numbered S2267. That bill was approved by the senate 33-4 on Nov. 9.

Donis Tracy contributed to this report.

<