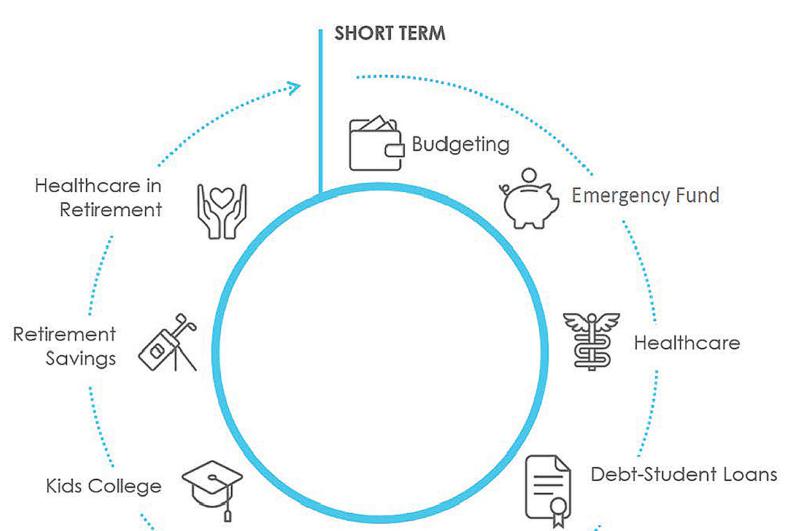

The 'wellness wheel' on the road to financial security

To be secure wherever you are on your financial journey, you need to focus on your short- and long-term goals.

That means handling day-to-day money tasks, like:

-- Budgeting

-- Building up emergency savings

-- Paying down student loans or credit card debt.

But it also includes considering long-term financial goals, such as:

-- Saving for kids' college

-- Setting up a retirement plan

-- Allowing for future health care costs.

To balance these needs, it helps to have a financial game plan -- one that allows you to get a clear picture of your financial reality and your financial goals. That way, you have an idea of the steps you need to take to stay financially well and secure.

One approach is to visualize your plan as a "financial wellness wheel" that shows the relation between your short- and long-term goals.

Understanding the relationship between your short- and long-term goals can help you determine priorities. Then -- taking advantage of the information, resources, and solutions available to you -- you can make decisions and plans that you believe are right for you.

Short-term goals

Budgeting -- The first step in any financial wellness plan is setting up a budget. It is essentially a running account of what you are making, spending, and keeping over time -- and it is essential to good personal finance and wealth building. It should encompass not only day-to-day spending, but also account for saving and investing goals.

Emergency fund -- One of the first, early priorities in the wellness wheel cycle is to establish an emergency fund. This is a safety net to help pay the bills in the face of a job loss or an unexpected need, like a sudden repair cost or medical bill. Unfortunately, many people let this priority slip. Nearly one third of employed Americans have less than $1,000 saved for emergency expenses, according to one survey.1 The general recommendation is that if you are single, married with one income, or a business owner, you should have six months' worth of expenses saved. For two income earners with steady incomes and jobs, the recommendation is to have three months' worth saved.

Health care -- Illness or injury is a threat to anyone and everyone. Indeed, according to the Social Security Administration, a 20-year-old today has a one-in-four chance of being too ill or too hurt by injury to work at some point in their career.2 That's why it's important to have health care insurance in place. And some aspects of health care coverage these days, such as Health Savings Accounts, allow for additional benefits down life's road. In the same vein, disability income insurance should be considered, especially if the loss of a paycheck over a significant amount of time could have negative consequences for you or your family.

Debt -- Paying off a student loan or wrestling with a credit card balance is a fact of life for many people. And sometimes debt is necessary to achieve certain goals in life, like purchasing a home. But without acknowledging and having a plan to deal with debt's impact on your financial circumstances, it can spiral out of control. That's why a debt management plan should be part of your financial wellness wheel.

Family protection -- As you continue along in your career, and with help from the steps above, the standard of living for you and your family is likely to improve and your assets grow. And so, your financial wellness wheel will turn to protecting those gains and ensuring that your family can carry on in the event you are gone. Certain kinds of life insurance can offer options for other financial needs as well.

Long-term goals

College savings -- Attending a private, four-year college or university can cost more than $57,000 per year on average, according to the College Board.3 If you want college to be an option for your children, and most parents do, then taking advantage of various college savings vehicles, such as 529 savings plans, should become part of your financial wellness wheel.

Retirement planning -- Today's needs are important, but so are those that will come in your old age. To that end, planning for retirement early and taking advantage of retirement savings plans available to you are important spokes on the financial wellness wheel. That means looking at employer-offered retirement savings vehicles, like 401(k) plans, and other mechanisms to build your retirement savings.

Health care in retirement -- As you get older, your health situation is likely to become more complicated. That's an added consideration in your retirement planning and something that should be considered when looking at options available to you, like life insurance with long-term care riders, during your working years.

Flexibility

Of course, the financial wellness wheel is only one way to approach financial planning. Some may prefer the concept of a financial pyramid or using a financial goals methodology. The point is to approach your finances with a plan that will allow you to work toward your goals and adjust as your life circumstances warrant.

Indeed, different parts of the financial wellness wheel will have different importance at different times. For instance, once you've built an emergency fund, money can be redirected to other savings goals (until your living standards rise to the point that the emergency fund needs a boost). Or college saving might wait until you have children. The point is financial wellness should mean financial flexibility, because finances should adapt to life, and not the other way around.

1 PWC's ninth annual Employee Financial Wellness Survey. PwC US, 2020.

2 US Social Security Administration, "Disability Facts."

3 College Board, "Trends in College Pricing and Student Aid, 2021-2022."

Article originally written by Allen Wastler from MassMutual.

CHRISTINE BURKE IS A REGISTERED REPRESENTATIVE OF AND OFFERS SECURITIES THROUGH MML INVESTORS SERVICES, LLC. MEMBER SIPC (WWW.SIPC.ORG). SUPERVISORY ADDRESS: 280 CONGRESS STREET, SUITE 1300, BOSTON, MA, 02210. 617.439.4389. CRN:202602-304281